Please note, the indicators below are experimental and aim to create valuation approaches for the new asset class of Bitcoin. These charts are built as informative guides. There is no guarantee certain rules within each model will continue to apply as Bitcoin progresses along its adoption journey.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.

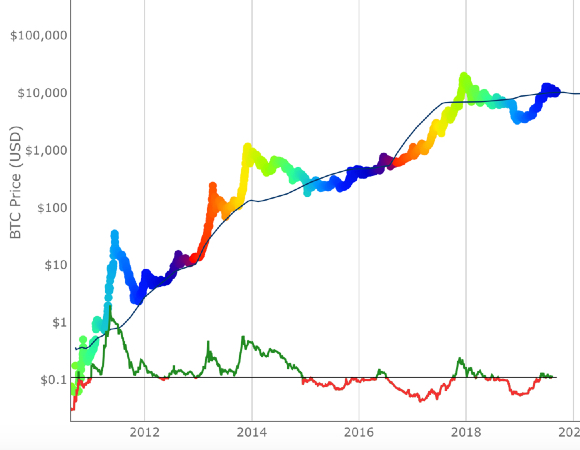

Long timeframe investor tool to identify under/oversold price periods

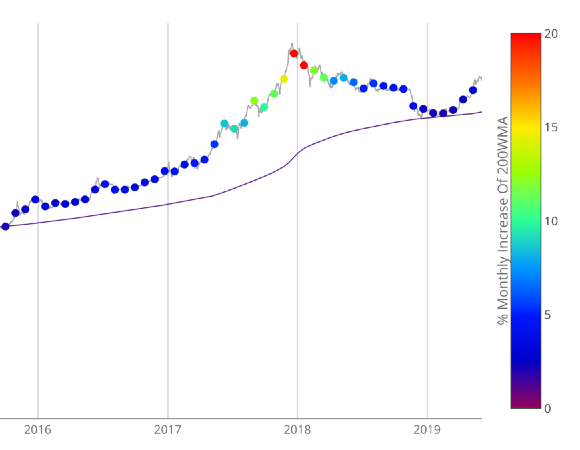

A simple heatmap system based on movements of the 200 week moving average.

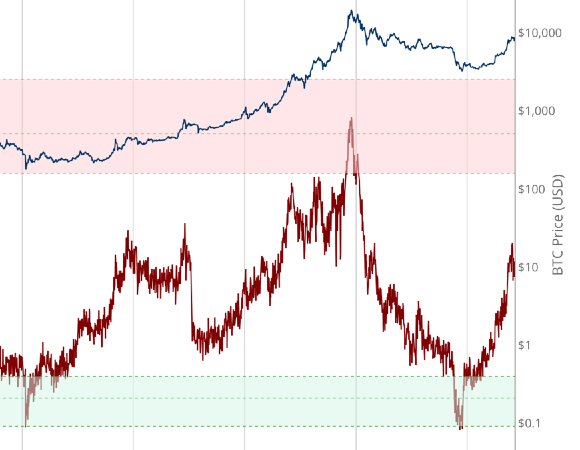

Relationship between daily bitcoin issuance and price.

Ratio of bitcoins in circulation relative to the amount of bitcoins annually mined, and this ratio's relationship with price

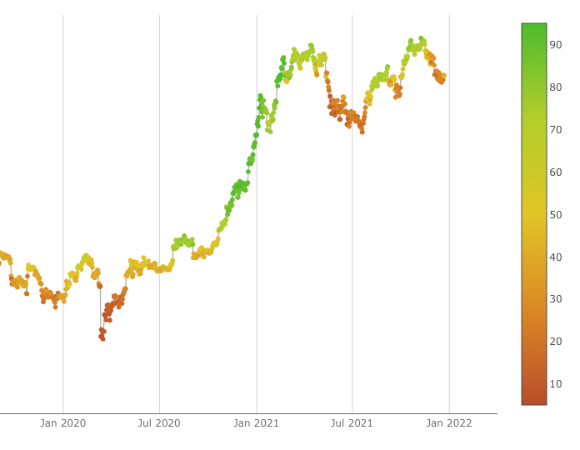

Market sentiment tool gauging investor fear and greed over time.

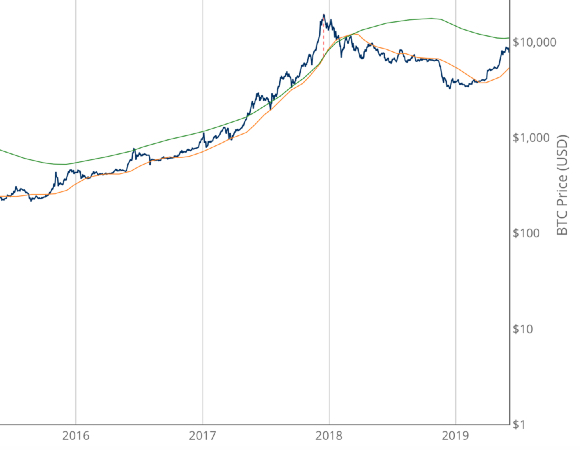

Moving average and moving average multiples to pick market cycle highs to within 3 days.

Uses Bitcoin's growth adoption curve and market cycles to identify both intracycle and full-cycle price highs.

The proportion of days in Bitcoin's traded history that it has been profitable to hold Bitcoin

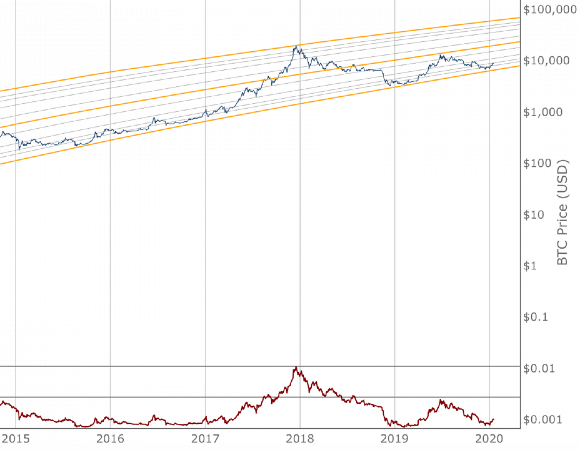

Bitcoin logarithmic growth curves